SHA vs SHIF Explained: What Actually Changed, and What Didn’t

If you’ve heard people arguing about SHA vs SHIF, you’re not alone.

Some say “NHIF imeisha.” Others say “Hii ni wizi tu, jina imebadilishwa.” Others are just quietly watching their payslip deductions go up and wondering:

“What exactly am I paying for now?”

Let’s slow this down and clear the confusion—calmly, factually, and practically.

💡 > Because the truth is this:

SHA and SHIF are not enemies. They are parts of the same system.

And once you understand that, everything else starts to make sense.

Table of Contents

- First: The One Thing Most Kenyans Are Getting Wrong

- What Actually Changed from NHIF

- What Didn’t Change (This Is Important)

- Who Feels the Impact Most Right Now

- The Gaps That Still Exist (Let’s Be Honest)

- The Smart Kenyan Strategy Under the New System

- Final Word: This Is Not a Battle—It’s a System

First: The One Thing Most Kenyans Are Getting Wrong

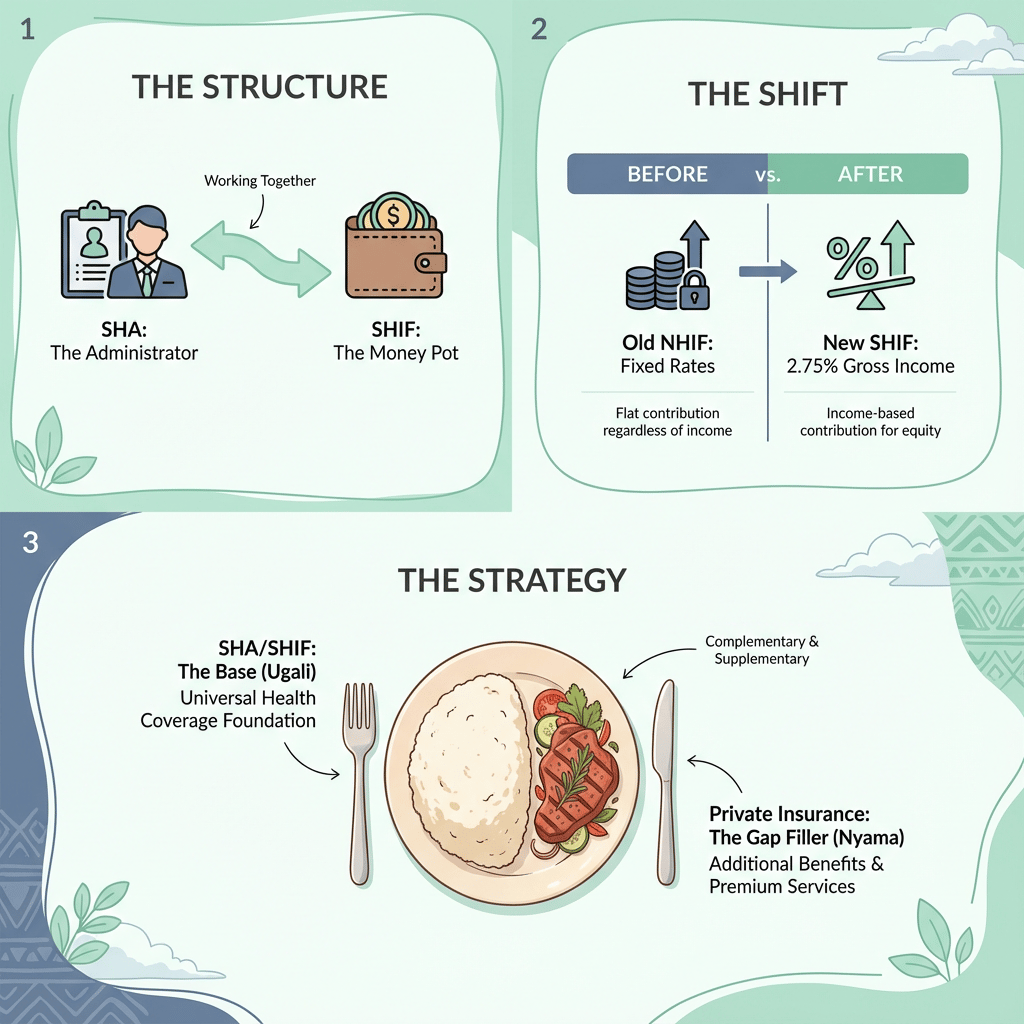

Many people think SHA vs SHIF means two different options.

It doesn’t.

Here’s the simple breakdown:

- Social Health Authority (SHA) → The administrator. The body that runs, regulates, and oversees the system.

- Social Health Insurance Fund (SHIF) → The money pot. The actual insurance fund that collects contributions and pays hospitals.

Think of it like this:

- SHA = the manager

- SHIF = the wallet

They work together. One cannot exist without the other.

What Actually Changed from NHIF

A lot did change—and some of it affects your pocket directly.

1. Flat Rates Are Gone

Under National Hospital Insurance Fund (NHIF):

- Salaried workers paid fixed bands

- Self-employed paid a flat KES 500

Under SHIF:

- Everyone contributes 2.75% of gross income

- Minimum and maximum caps apply

👉 Result: Some people pay more. Some pay less. Most middle-income earners pay more.

2. Universal Coverage Is the Goal

The system is now designed around:

- Households, not individuals

- Mandatory participation

- Bringing informal sector workers into the same pool

👉 Big idea: No more “NHIF is for some people.” Everyone is in.

3. Benefits Are More Standardised

In theory:

- Clearer benefit packages

- More predictable funding

- Better planning for public health facilities

In practice? We’re still in transition.

What Didn’t Change (This Is Important)

This is where expectations need to be realistic.

1. Public Hospitals Are Still the Backbone

SHA/SHIF is still primarily built around:

- Public hospitals

- Faith-based facilities

- Lower-cost care environments

If you were expecting automatic access to top private hospitals—that hasn’t changed.

2. Capacity Is Still a Challenge

More people in the system doesn’t magically mean:

- Shorter queues

- More doctors

- More ICU beds

Those improvements take time, money, and infrastructure.

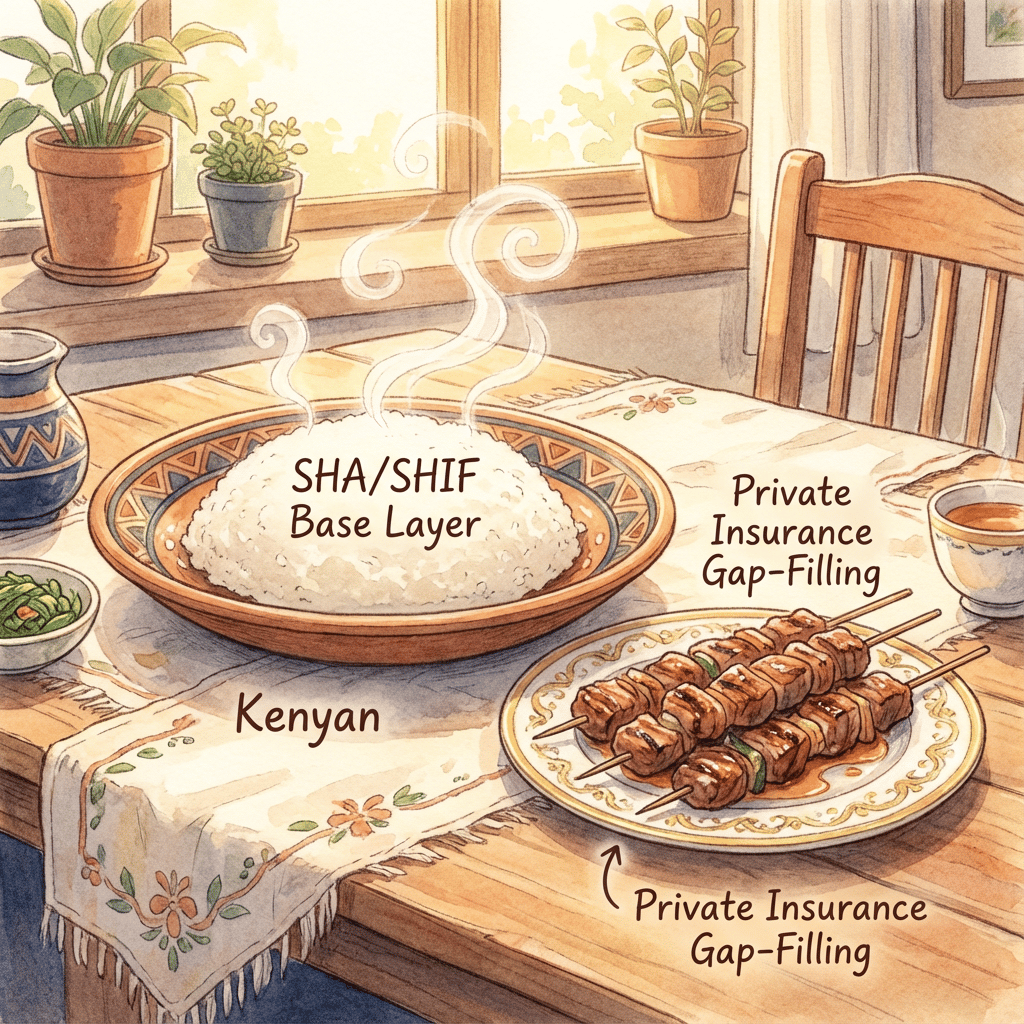

3. SHA/SHIF Is Still a Foundation—Not the Finish Line

This is the biggest misunderstanding.

SHA/SHIF was never meant to:

- Replace private insurance

- Guarantee speed or comfort

- Cover every scenario at top-tier facilities

It’s a base layer, not a premium solution.

Who Feels the Impact Most Right Now

Salaried Kenyans

- Higher deductions

- Automatic compliance

- Fewer choices—but predictable access

Freelancers & Informal Workers

- Manual payments

- Discipline required

- Big risk if payments lapse

Middle-Income Families

- Paying more

- Still need private cover for preferred hospitals

- Feel the “double cost” most

The Gaps That Still Exist (Let’s Be Honest)

Even with SHA + SHIF in place, these gaps remain:

- ❌ Full private hospital access

- ❌ Fast specialist care

- ❌ Private maternity in top facilities

- ❌ Large cancer or ICU bills at private hospitals

This is not a failure of the system. It’s a design reality.

The Smart Kenyan Strategy Under the New System

Instead of fighting the system or ignoring it, here’s the approach that actually works:

1. Accept SHA/SHIF as Non-Negotiable

You are in. Whether you like it or not.

So use it for:

- Public hospitals

- Primary care

- Stabilisation

- Basic inpatient needs

2. Use Private Insurance to Fill the Gaps

Private cover is where you get:

- Choice of hospital

- Speed

- Comfort

- Higher limits for emergencies

Think:

- SHA/SHIF = ugali

- Private insurance = nyama

You need both for a proper meal.

3. Don’t Over-Insure, But Don’t Under-Insure

You don’t need the fanciest private plan.

But you do need:

- Strong inpatient cover (2M–5M)

- A hospital network you trust

- No surprise sub-limits

Final Word: This Is Not a Battle—It’s a System

SHA vs SHIF is not a fight. It’s a structure.

The real question isn’t:

“Is this system perfect?”

It’s:

“How do I protect myself and my family within this reality?”

Kenyans who understand this early will:

- Avoid panic

- Avoid misinformation

- Make smarter insurance decisions

The system is here. The smart move is strategy, not resistance.

🟢 What You Should Do Next

- Understand what SHA/SHIF actually covers

- Identify where it stops

- Fill the gap before you need it

Because insurance only works when it’s planned before the emergency—not after.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.