You Bought Medical Insurance. Now What? The Smart User's Guide to Your Policy

So, you finally did it. You compared the plans, survived the sales pitch, and bought medical insurance. First of all — congratulations. That’s a smart move.

But here’s the part no one tells you: buying the cover is just step one. The real work is in using it well — otherwise, your “peace of mind” can quickly turn into a rude shock when your insurer says “sorry, not covered.”

This guide breaks down the smart moves you should make right after buying your policy so you actually get the protection you paid for.

Table of Contents

- 1. Save All the Right Documents (and Numbers)

- 2. Understand Your Waiting Periods

- 3. Learn Your Hospital Network

- 4. Know Your Sub-Limits

- 5. Stay on Top of Renewals

- 6. Use Your Cover Proactively

- 7. Learn the Claims Process (Before You Need It)

- Final Word: Insurance is a Tool — Use It Right

1. Save All the Right Documents (and Numbers)

- Store your policy document, Table of Benefits, and hospital list somewhere you can access fast (phone, email, WhatsApp folder).

- Save your insurer’s emergency hotline on your phone.

- If you’re using an agent or broker, keep their number on speed dial.

👉 Smart Tip: Create a WhatsApp group for family with the card photos + hospital list. Emergencies are not the time for scavenger hunts.

2. Understand Your Waiting Periods

Most covers don’t kick in instantly. The fine print matters:

- General illness: usually 30 days.

- Maternity: 10–12 months.

- Chronic or surgical: 1–2 years.

👉 Smart Tip: Mark your waiting period end dates on your calendar. That way, you’ll know exactly when certain benefits start.

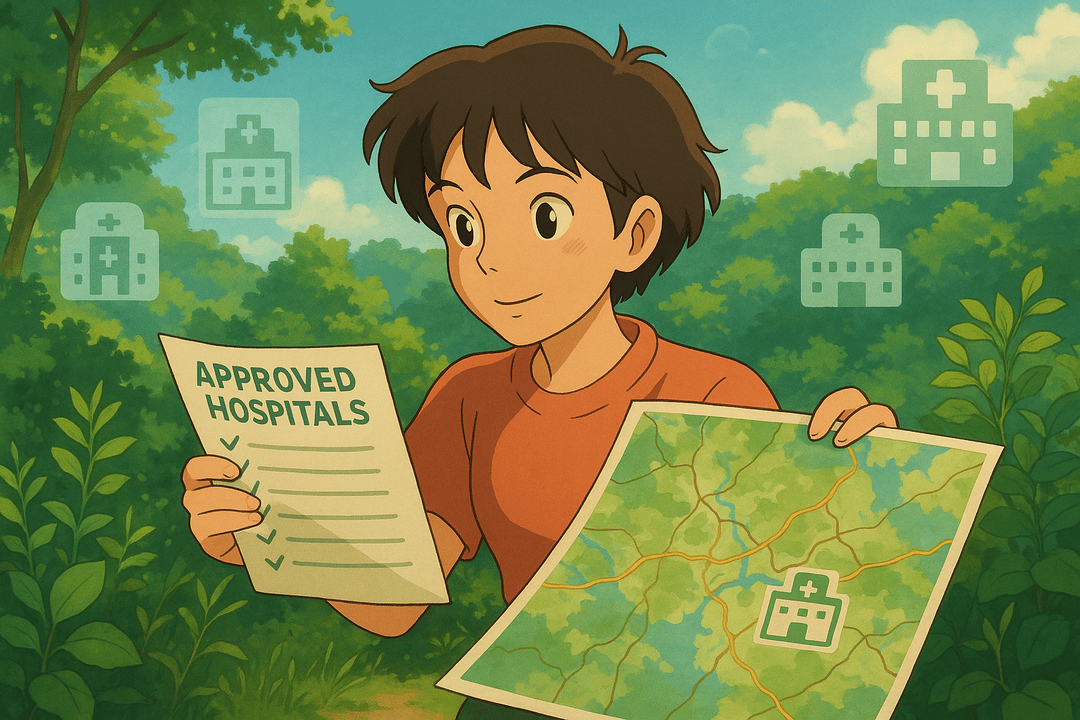

3. Learn Your Hospital Network

Your shiny new insurance card is only useful in approved hospitals. Walk into the wrong one, and it’s “cash only.”

👉 Smart Tip:

- Download or print your hospital list.

- Highlight the nearest ones to home, work, or school.

- Visit at least one in person before you need it.

4. Know Your Sub-Limits

That 3M inpatient cover? It may only cover 150K for surgery, 200K for ICU, or 50K for maternity complications. That’s where most people get caught.

👉 Smart Tip: Read the Table of Benefits line by line. If the sub-limits don’t match your health risks (e.g., surgery for athletes, maternity for young families), adjust now.

5. Stay on Top of Renewals

Insurance only works if it’s active. One missed payment = lapse = denied claims. And sometimes, your waiting periods restart from zero.

👉 Smart Tip:

- Set auto reminders.

- Align premium dates with your cash flow (don’t set it during rent/school fees season).

- Ask your agent to chase you down — a good one will.

6. Use Your Cover Proactively

Don’t just wait for a crisis. If your plan has outpatient, dental, or optical, use them. Preventive care saves you bigger costs later.

👉 Smart Tip: Even one annual check-up can reveal issues early and make the cover worth it.

7. Learn the Claims Process (Before You Need It)

Every insurer has its own rules:

- Some settle directly with the hospital.

- Others reimburse you after you pay.

- Some need pre-authorization for major procedures.

👉 Smart Tip: Call your insurer once now and ask: “What’s the process if I need to be admitted?” Better to know when you’re calm than when you’re panicked.

Final Word: Insurance is a Tool — Use It Right

Buying insurance is not the end. It’s the beginning. The difference between people who win with cover and those who end up on WhatsApp harambees isn’t luck — it’s preparation.

So today:

- Save your documents.

- Learn your network.

- Mark your dates.

- Pay on time.

Because you didn’t buy insurance just to carry a card. You bought it so when life throws you a curveball, you’re ready.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.