NHIF Supa Cover vs. Private Insurance: I Broke Down the REAL Costs for a 28-Year-Old in Nairobi

Health insurance in Kenya is like Nairobi rent — everyone talks about it, but the numbers never seem to add up the same way.

At the heart of the debate is this question: “Do I stick with NHIF Supa Cover (now SHA), or do I top up with private insurance?”

Let’s break this down with a real scenario: a 28-year-old, single, living and working in Nairobi. No kids yet, no major pre-existing conditions, just trying to stay sorted without going broke.

Table of Contents

- What NHIF Supa Cover (Now SHA) Actually Gives You

- What Private Insurance Adds to the Table

- Cost Comparison for a 28-Year-Old Earning 80K in Nairobi

- The Reality Check

- Summary

What NHIF Supa Cover (Now SHA) Actually Gives You

NHIF Supa Cover — now transitioning into the new Social Health Authority (SHA) — is Kenya’s default safety net.

- Monthly Contribution: Flat KES 500 (under old NHIF). Under SHA, it’s 2.75% of gross income with a minimum of 300 and maximum of 5,000. For a 28-year-old earning KES 80,000/month, that’s KES 2,200/month.

- Access: Mainly public and mission hospitals, some private clinics (but usually with long queues).

- Benefits:

- Inpatient care in public facilities.

- Outpatient services in selected hospitals.

- Maternity covered (but in designated hospitals).

- Chronic illness and cancer treatment available, but usually with caps and long waits.

Bottom line: It’s basic. It will keep you from being totally exposed, but it won’t guarantee quick access to top-tier hospitals like Aga Khan or Nairobi Hospital.

What Private Insurance Adds to the Table

Private medical cover is your upgrade — it’s what gets you into better hospitals, faster queues, and more choice.

For a 28-year-old in Nairobi, here’s what entry-level private cover looks like:

- Inpatient Cover:

- Limit: 1–3M (depends on insurer).

- Cost: KES 50K–90K per year (~KES 4K–7.5K/month).

- Outpatient Add-On:

- Limit: 30K–50K.

- Cost: KES 25K–45K per year (~KES 2K–3.7K/month).

- Maternity (if needed in future):

- 10–12 month wait.

- Adds ~KES 20K–30K/year.

Best Features of Private Cover:

- Accepted in top private hospitals.

- Covers lab tests, scans, and pharmacy if outpatient is included.

- Faster claims, less bureaucracy.

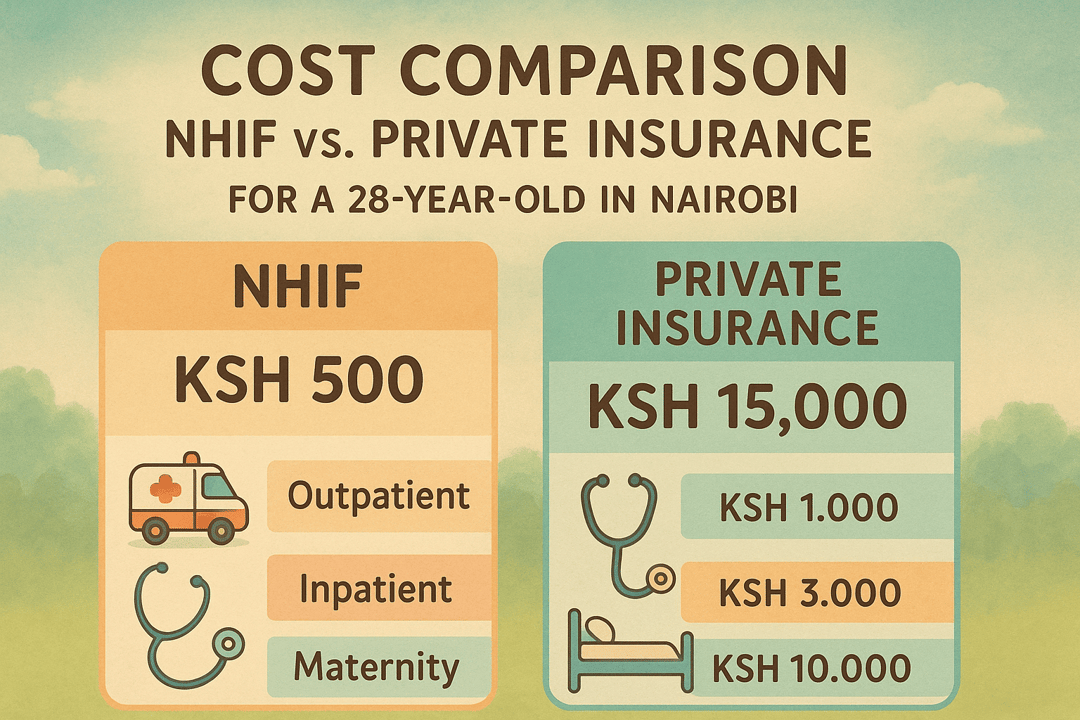

Cost Comparison for a 28-Year-Old Earning 80K in Nairobi

| Cover Type | Monthly Cost | Annual Cost | What You Get |

|---|---|---|---|

| NHIF / SHA (2.75%) | KES 2,200 | KES 26,400 | Public hospital care, limited private |

| Private Inpatient (2M–3M limit) | ~KES 6,000 | ~KES 72,000 | Admission to top-tier hospitals |

| Private Outpatient Add-On | ~KES 3,000 | ~KES 36,000 | GP, labs, scans, meds |

| Total Combo (NHIF + Private In & Out) | ~KES 11,200 | ~KES 134,400 | Comprehensive care, public + private |

The Reality Check

If you’re 28, healthy, and single, SHA alone won’t kill you — but it will frustrate you. Long queues, limited facilities, and uncertainty when you want quality care.

Private insurance gives you choice and speed — but it comes at a cost that can feel heavy if your cash flow is tight.

👉 The smart move? Do both.

- SHA (mandatory) gives you a base layer of protection.

- A lean private inpatient plan (2M+ limit) keeps you safe from catastrophic bills.

- Add outpatient if you visit doctors often or want full peace of mind.

Summary

For a 28-year-old in Nairobi, the real cost of feeling “sorted” is about KES 11,000 per month if you combine SHA + private inpatient + outpatient.

That’s less than some people’s rent in Kilimani — and way less than a single emergency bill at a private hospital.

Your choice isn’t just about money. It’s about whether you want to spend your sick day in a queue… or in a hospital bed already being treated.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.