Lapsed and Lost: A Cautionary Tale of Letting an Insurance Policy Expire

In the chaos of life, it’s easy to miss a premium payment. Work deadlines pile up, school fees are due, your car needs a service — and suddenly, insurance renewal slips to the bottom of your to-do list.

No big deal, right? Until it is.

This is the story of James and Mercy, a Nairobi couple who learned the hard way what happens when you let your medical cover lapse — and why renewing on time isn’t a box-ticking exercise, but a lifeline.

Table of Contents

- The Lapse That Looked Small

- The Unthinkable Knocked

- The Hidden Cost of a Lapse

- The Lesson: Insurance Is Only as Good as Its Continuity

- How to Keep Your Cover Alive

- Final Word

The Lapse That Looked Small

James and Mercy had been faithfully paying their family medical cover for three years. Their premiums were manageable, and they liked knowing their two children were protected.

But last December, with Christmas expenses, school shopping, and Mercy’s side-hustle cash tied up in stock, they missed their renewal date.

“It was just one week late,” Mercy recalls. “We figured, what’s the harm? We’ll pay next month.”

The Unthinkable Knocked

Two weeks later, their six-year-old son developed severe abdominal pain. They rushed him to the hospital they always used — confident their cover had them sorted.

But when Mercy handed over the insurance card, the receptionist shook her head.

“Your policy has lapsed. Do you have cash or M-Pesa?”

They were asked for a KES 200,000 deposit before admission.

The Hidden Cost of a Lapse

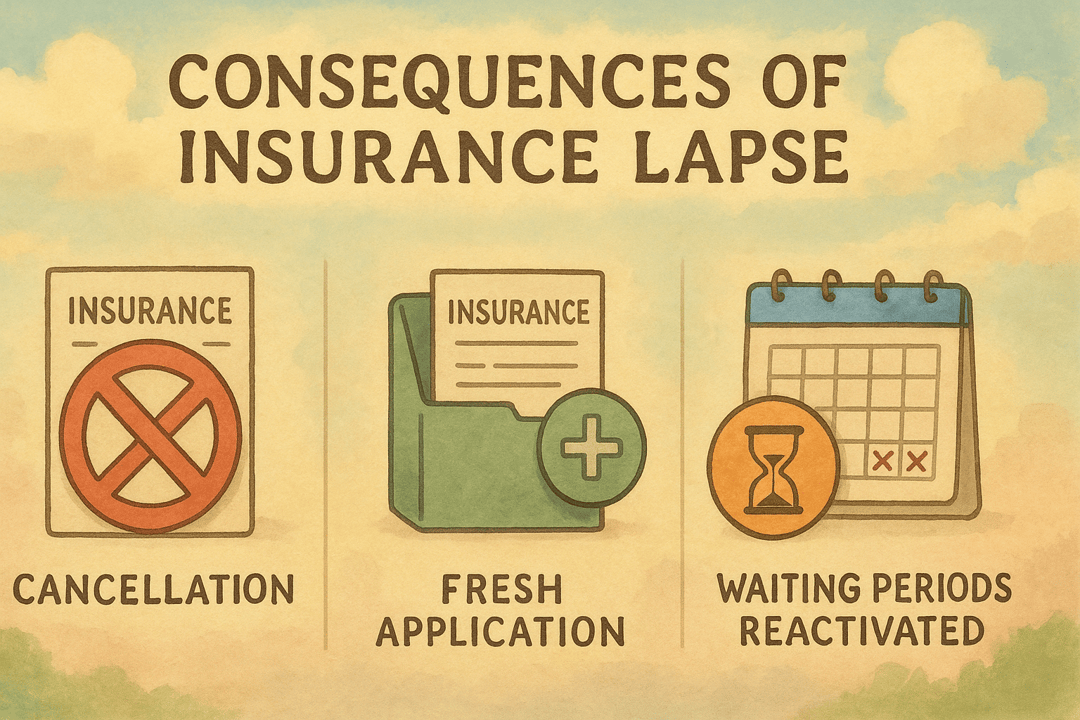

What James and Mercy didn’t know was that when a policy lapses, insurers can:

- Cancel the contract altogether.

- Require reapplication — sometimes with fresh medical tests.

- Reinstate the policy, but re-activate all waiting periods (so maternity, chronic, or surgery benefits are frozen again).

For their son’s surgery, they ended up raising funds from family and friends. The cover they had trusted for years was useless in their moment of need.

The Lesson: Insurance Is Only as Good as Its Continuity

It wasn’t that James and Mercy had a bad plan. Their only mistake was letting it lapse.

Insurance is a “silent friend” — it doesn’t shout for attention, but if you abandon it, it quietly walks away. And when you go looking for it in crisis, it may not come back.

How to Keep Your Cover Alive

Here are five simple ways to make sure you never end up in James and Mercy’s shoes:

- Set Auto-Reminders – Use your phone calendar for renewal dates, with alarms two weeks before.

- Automate Payments – Where possible, set up standing orders or M-Pesa auto-pay.

- Use an Agent or Broker – A good one will chase you down before lapse.

- Align Renewal Dates with Cash Flow – Some insurers allow flexible dates — don’t set yours at school fee season if you can avoid it.

- Keep a Policy Cushion – Even KES 500 a month set aside helps you stay ready when renewal comes.

Final Word

James and Mercy’s story is a painful reminder: it doesn’t take fraud, fine print, or medical exclusions to lose your cover. Sometimes, it’s just one missed payment.

Insurance only works if it’s active. Keep it alive, and it will keep you safe.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.