The "Affordable" Medical Cover Myth: A No-BS Guide for Young Kenyans

Health insurance in Kenya is marketed with shiny words like “affordable,” “comprehensive,” and “family-friendly.” But if you’ve ever tried comparing the plans, you know the reality: cheap doesn’t always mean safe — and affordable isn’t always what it looks like on the brochure.

This guide is for young Kenyans buying (or thinking about buying) their first cover. Let’s cut through the noise and deal with the facts, no PR spin.

Table of Contents

- Myth 1: Cheap Cover = Good Enough

- Myth 2: NHIF (SHA) Alone is Enough

- Myth 3: “Comprehensive” Means Everything is Covered

- Myth 4: You Can Start Small and Upgrade Later — Hassle-Free

- Myth 5: Lapsed Cover Can Easily Be Restarted

- So, What’s Actually Affordable for Young Kenyans?

- Final Word: Affordability ≠ Peace of Mind

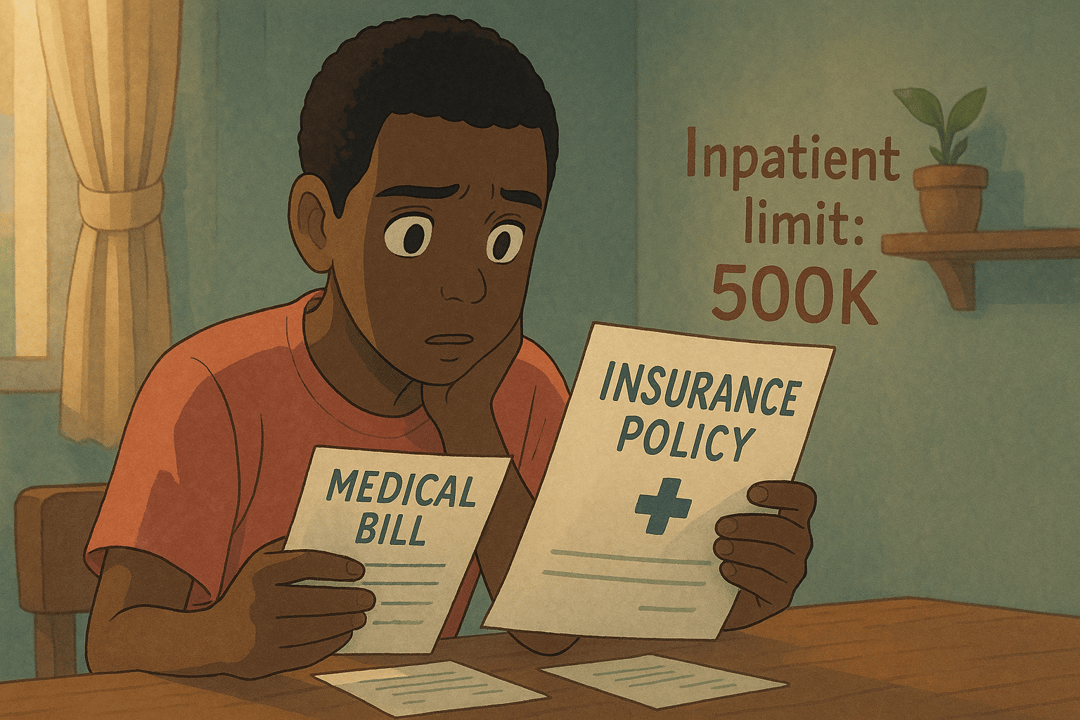

Myth 1: Cheap Cover = Good Enough

The adverts will shout: “KES 999 per month only!” But look closely at the Table of Benefits:

- Inpatient limit: maybe 500K.

- Sub-limit for surgery: 100K.

- Outpatient: capped at 10K.

Now imagine one accident at a private hospital in Nairobi. Bill: 300K+. The insurer pays 100K. You pay the rest.

👉 Reality Check: The cheapest cover often gives you a false sense of security. You’re better off paying a bit more for a 2M–3M inpatient plan that actually cushions you.

Myth 2: NHIF (SHA) Alone is Enough

Yes, the new Social Health Authority (formerly NHIF) is mandatory — and it helps. But let’s be honest:

- Queues in public hospitals are long.

- Top private hospitals? Mostly not covered.

- Emergencies? You’ll still need a deposit.

👉 Reality Check: Think of SHA as your ugali base. It will keep you alive, but if you want nyama choma (comfort, speed, choice), you need to top it up with private cover.

Myth 3: “Comprehensive” Means Everything is Covered

This is the sneakiest one. “Comprehensive” sounds like you’ll be sorted for anything. But in Kenya insurance-speak, it usually means:

- Some inpatient + some outpatient.

- Limits that can be shockingly small.

- Plenty of exclusions in the fine print.

👉 Reality Check: Don’t buy words. Buy benefits. Always read the Table of Benefits before you sign.

Myth 4: You Can Start Small and Upgrade Later — Hassle-Free

Many young Kenyans think: “I’ll just get the cheapest plan now, then upgrade when I’m making more.” The catch? Upgrading often means:

- Fresh medical tests.

- New waiting periods.

- Higher premiums that can feel unaffordable all at once.

👉 Reality Check: Start with the best inpatient cover you can afford now. Add extras later, but don’t gamble with the foundation.

Myth 5: Lapsed Cover Can Easily Be Restarted

Hakuna kitu inachoma like letting your cover lapse.

- Some insurers treat you as a brand-new client.

- Waiting periods reset.

- Claims during the gap are automatically rejected.

👉 Reality Check: Insurance only works if it’s active. Treat your premium like rent — si kitu ya kuchezea.

So, What’s Actually Affordable for Young Kenyans?

For most young Nairobians, here’s a practical structure:

- SHA/NHIF (mandatory): ~KES 2,200/month (on an 80K income).

- Private Inpatient (2M limit): ~KES 2,000–3,000/month.

- Outpatient: Add later if budget allows.

👉 Total: KES 4,000–5,000/month — about the cost of two Friday nights out.

Not pocket change, but way cheaper than crowdfunding KES 500K on WhatsApp after one bad accident.

Final Word: Affordability ≠ Peace of Mind

Don’t fall for the myth. The question isn’t: “Can I find the cheapest plan?” The real question is: “If I end up admitted tomorrow, will this plan actually save me?”

Young Kenyans, your health is your hustle. Protect it with cover that works — not cover that just looks cheap on paper.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.