The 5-Step Decision Framework: How to Choose the Best Health Insurance in Kenya—Systematically & Without a Headache

You’re staring at a dozen browser tabs. Each one displays a different Kenyan insurance provider, promising security, peace of mind, and comprehensive cover. Brochures pile up on your desk, filled with jargon—co-pays, sub-limits, provider panels, exclusions. Friends and family offer conflicting advice: “NHIF is enough,” “That company never pays,” “Just get the cheapest one.”

The result? A quiet, creeping sense of paralysis. The decision feels impossibly complex, the stakes terrifyingly high. It’s like being dropped in the middle of a dense, unfamiliar jungle and being told to find your way out—without a map, a compass, or even a clear destination. You know you need to move, but every path looks fraught with peril.

Table of Contents

- Step 1: The Personal Risk Audit — Architecting Your 'Why' Before Your 'What'

- Step 2: The Budget Reality Check — Defining a Sustainable Premium

- Step 3: The Provider Scorecard — Comparing Insurers Beyond the Price Tag

- Step 4: The Policy Autopsy — Reading the Fine Print Like a Forensic Investigator

- Step 5: The Final Litmus Test — Three Non-Negotiable Questions Before You Sign

- From Chaos to Control: Your Turn

Step 1: The Personal Risk Audit — Architecting Your 'Why' Before Your 'What'

This is the most critical and most frequently skipped step. Before you look at a single insurance company, you must first look inward. You cannot buy the right solution if you haven’t precisely defined the problem. Choosing health insurance isn't about buying a product; it's about mitigating specific, personal risks.

Think of yourself as a security consultant for your own life. Your first job is to conduct a thorough threat assessment. What are you actually trying to protect yourself and your family from?

Most people think of "hospital cover" as a single block. This is a mistake. To do this properly, you must deconstruct your risk into four key pillars. Grab a notebook or open a document and answer these questions honestly.

The Personal Risk Audit Worksheet

Pillar 1: Acute & Accidental Events This is the most common trigger for seeking insurance—the sudden, unexpected event.

- What is your lifestyle? Are you active in sports? Do you have a long daily commute in heavy traffic?

- Who are your dependents? Do you have young, energetic children prone to playground mishaps?

- The Bottom-Line Question: If a serious accident happened tomorrow requiring surgery and a week-long hospital stay at a top-tier facility like Aga Khan or Nairobi Hospital, what level of financial impact would that have on my savings?

Pillar 2: Chronic & Long-Term Conditions These are the slow-burn risks that can become incredibly expensive over time.

- What is your family medical history? Is there a prevalence of conditions like diabetes, hypertension, or heart disease?

- What are your personal health indicators? Be honest with yourself about your lifestyle, diet, and stress levels.

- The Bottom-Line Question: If I were diagnosed with a chronic condition requiring lifelong medication and regular specialist visits, do I have a plan to manage those recurring costs without liquidating my investments?

Pillar 3: Major & Critical Illness This is the low-probability, high-impact category that represents the greatest threat to financial solvency.

- Again, what does your family history show regarding cancer, stroke, or organ failure?

- What is your financial exposure? The cost of treating a critical illness can easily run into millions of shillings, far exceeding typical inpatient limits.

- The Bottom-Line Question: Does my financial plan account for a catastrophic event that could cost KES 5-10 million or more?

Pillar 4: Planned Life Stages & Routine Care This pillar covers predictable, high-cost life events and day-to-day health maintenance.

- Are you planning to start or expand your family in the next 1-3 years? If so, maternity cover is non-negotiable, and it comes with significant waiting periods (typically 10-12 months).

- How often do you or your family members currently visit a GP, dentist, or optician? These outpatient costs can add up significantly.

- The Bottom-Line Question: Is my goal to have insurance cover only for emergencies, or do I want a plan that helps manage predictable, routine healthcare costs?

Illustrative Case Study: Two Different Audits, Two Different Blueprints

- David: A 28-year-old single software developer. His Risk Audit reveals his primary concerns are Pillar 1 (Acute Events) due to his love for mountain biking, and Pillar 4 (Routine Care) because he values regular dental check-ups. His family history is clear, so his concern for chronic and critical illness is lower, though not zero.

- His Ideal Policy: A strong inpatient cover for accidents, robust outpatient benefits, and perhaps a lower overall limit to keep premiums affordable. Maternity cover is irrelevant.

- The Njoroges: A couple in their mid-30s with a 4-year-old child and plans for a second. Their Risk Audit is completely different. Pillar 4 (Maternity) is a top priority. Pillar 1 (Acute Events) is high because of their child. Pillar 2 (Chronic Conditions) is a moderate concern, as Mr. Njoroge’s father has hypertension.

- Their Ideal Policy: A comprehensive family plan with a high inpatient limit, excellent maternity benefits with a short waiting period, dental/optical for the whole family, and coverage for chronic conditions.

By completing this audit, you stop shopping for "health insurance" and start shopping for a solution that precisely matches your risk profile. You now have a blueprint.

Step 2: The Budget Reality Check — Defining a Sustainable Premium

Now that you know what you need to cover, you must determine what you can realistically afford. This sounds simple, but it’s where many people make their first critical error, falling into the “Affordability Trap.”

The Trap: Why the Cheapest Plan is Often the Most Expensive

A low premium is seductive. It feels like a win. But an insurance policy with a rock-bottom premium often hides crippling weaknesses that only become apparent when you actually need to use it. These can include:

- Painfully Low Sub-Limits: A plan with a KES 2 million inpatient limit might look great, but it could have a sub-limit of only KES 150,000 for a specific surgery, leaving you to cover the rest.

- High Co-Payments: A 20% co-pay on a KES 1 million hospital bill means you are still on the hook for KES 200,000 out-of-pocket.

- A Severely Restricted Hospital Network: The cheap plan might only cover you in a handful of lower-tier facilities, forcing you to pay 100% of the bill if you go to your preferred hospital.

Suddenly, the "cheap" plan has become astronomically expensive. The best policy is one you can sustainably afford for the long term. A policy you lapse after a year because the premiums were too high is a complete waste of money.

How to Set a Realistic Budget:

- Calculate Your Discretionary Income: Understand exactly what’s left after all your essential expenses and savings contributions are accounted for.

- Apply a Percentage Rule (as a starting point): Financial planners often suggest allocating between 5-10% of your net monthly income towards insurance premiums (including health, life, etc.). This is a guideline, not a rule. Your Personal Risk Audit from Step 1 will determine if you need to be at the higher or lower end of this range.

- Stress-Test Your Budget: Ask yourself: "If my income dropped by 15% next year, could I still comfortably afford this premium?" If the answer is no, you might be over-extending yourself.

Illustrative Case Study: The Njoroges Face Reality

The Njoroges' Risk Audit (Step 1) screamed for a top-tier, all-inclusive family plan. The quotes for this "Rolls-Royce" cover came in at KES 450,000 per year. Their budget reality check showed they could sustainably afford a maximum of KES 280,000.

Instead of giving up, this constraint forces a smart, strategic trade-off. They work with a broker to find a plan in their budget that still meets their core needs. They compromise by accepting a plan with a 10% co-pay on outpatient services and a slightly smaller hospital network, but one that still includes their top three preferred hospitals and has excellent maternity cover.

This isn’t failure; it's financial intelligence. They secured a robust plan that they won't be forced to abandon in two years.

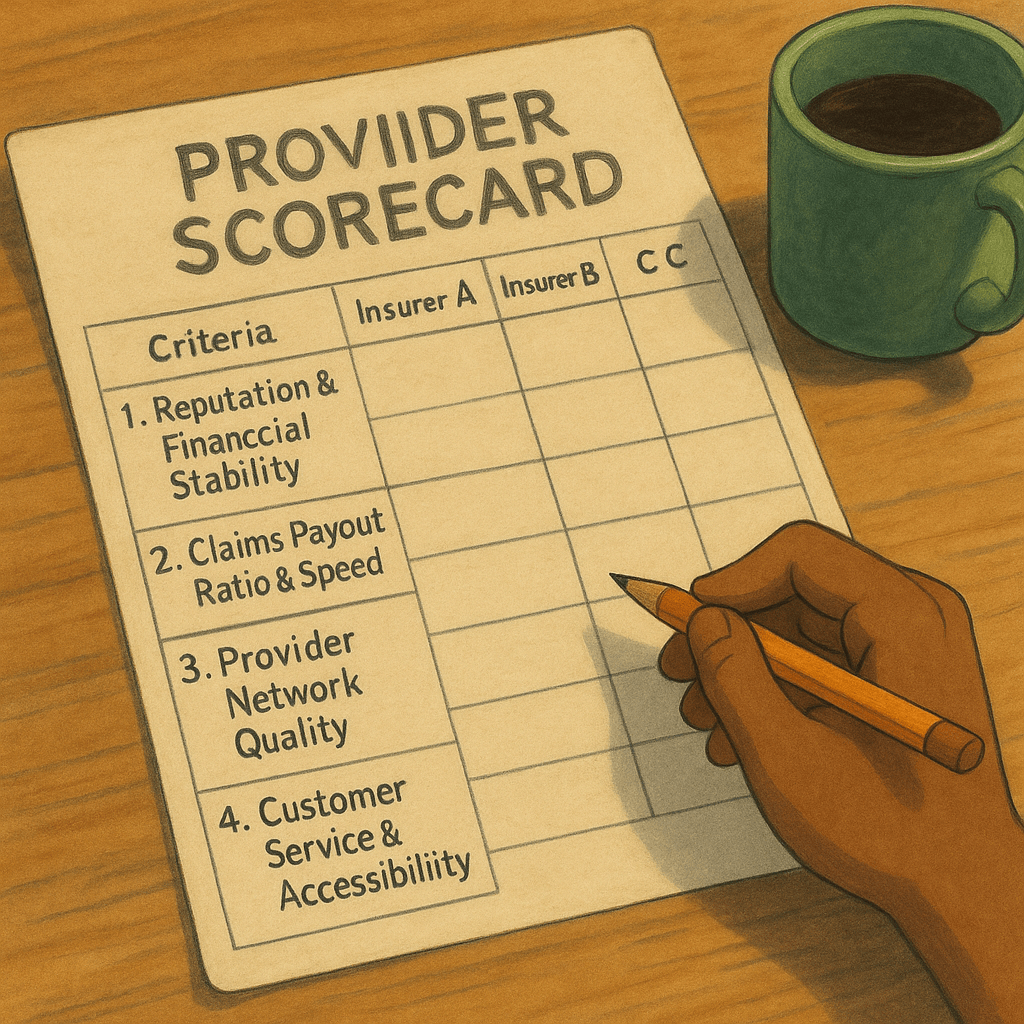

Step 3: The Provider Scorecard — Comparing Insurers Beyond the Price Tag

With your needs defined and your budget set, you can now start evaluating specific insurance companies. But do not just compare premium quotes. You are choosing a long-term partner for your family’s most critical moments. You must evaluate the company itself.

Create a simple spreadsheet or table—your Provider Scorecard—and rate your top 3-4 contenders on these four non-negotiable criteria.

The Provider Scorecard Template

| Criteria | Insurer A | Insurer B | Insurer C |

|---|---|---|---|

| 1. Reputation & Financial Stability | |||

| 2. Claims Payout Ratio & Speed | |||

| 3. Provider Network Quality | |||

| 4. Customer Service & Accessibility |

Let's break down how to assess each one.

1. Reputation & Financial Stability: A flashy new company might offer low rates, but will they be around in ten years?

- How to Assess: How long have they operated in Kenya? What is their reputation in the market (ask financially savvy friends or a trusted broker)? A quick search on business news sites can reveal their financial health or any recent turmoil.

2. Claims Payout Ratio & Speed (The Most Important Metric): This number represents the percentage of claims an insurer approves and pays out versus the total they receive. A high ratio is a strong positive signal. Speed is just as important—will they pay a hospital deposit promptly at 2 AM on a Sunday?

- How to Assess: This can be tricky, as not all insurers publish it. However, you can and should ask them directly. "What was your claims payout ratio last year?" Their willingness (or unwillingness) to answer is revealing. Check online forums and social media for real-world customer experiences regarding claims. This is where a good independent broker adds immense value, as they have firsthand experience with which companies pay promptly and which ones fight every claim.

3. Provider Network Quality & Breadth: The best policy is useless if it’s not accepted at the hospitals you want to use.

- How to Assess: Don't just glance at the list; scrutinize it. Are your preferred family doctor and local clinic on the list? Does it include the top-tier hospitals for major emergencies (Nairobi Hospital, Aga Khan, MP Shah, Karen Hospital)? Is there a good geographic spread if you travel within Kenya?

4. Customer Service & Accessibility: When you’re facing a medical emergency, the last thing you want is an unresponsive insurance company.

- How to Assess: Call their customer service line with a few pre-prepared questions. How long does it take to get a human on the phone? Are they knowledgeable and helpful? Do they have a 24/7 emergency hotline? Is their digital portal or app user-friendly?

Illustrative Case Study: The Scorecard Reveals the Truth

Imagine Insurer A and Insurer B offer the Njoroges identical plans at KES 275,000. On paper, they look the same. But on the Scorecard:

- Insurer A: Has a reputation for slow claims processing, its hospital network excludes two major hospitals, and their customer service line is only open during business hours.

- Insurer B: Is known for fast payouts, has a comprehensive network including all major hospitals, and operates a 24/7 support center.

The choice is now crystal clear. The scorecard allowed the Njoroges to look past the price and see the true value.

Step 4: The Policy Autopsy — Reading the Fine Print Like a Forensic Investigator

You’ve chosen a promising provider. Now, you must dissect their specific policy document—usually called the "Benefit Schedule" or "Table of Benefits." This is where the promises of the brochure meet the reality of the contract. Approach this not as a reader, but as a forensic investigator, actively hunting for clues and red flags.

Your Forensic Investigation Checklist:

- Waiting Periods: Insurers impose these to prevent people from buying cover only when they know they need it. They are not negotiable.

- What to Look For:

- General Waiting Period: Typically 30 days for illness (accidents are often covered immediately).

- Maternity: Almost always 10-12 months. You must have the cover in place for nearly a year before conception.

- Specific Conditions: Many policies have 1-2 year waiting periods for things like chronic conditions, specific surgeries (e.g., hysterectomy, hernia repair), cancer treatment, etc.

- Red Flag: A policy with unusually long waiting periods for common conditions.

- What to Look For:

- Exclusions: This is the list of things the policy will not cover under any circumstances.

- What to Look For: Common exclusions include pre-existing conditions (unless explicitly declared and accepted, often with a surcharge), cosmetic procedures, self-inflicted injuries, participation in riots, and often costs related to declared pandemics.

- Red Flag: A long, ambiguous list of exclusions that could be interpreted broadly by the insurer.

- Sub-limits: This is the single biggest "gotcha" in health insurance. A policy might have a high overall (inpatient) limit, but tiny sub-limits for specific treatments that render the headline number meaningless.

- What to Look For: Scrutinize the limits for: organ transplant, cancer treatment, dialysis, ICU/HDU costs, non-accidental dental/optical, psychiatric care, and specific surgical procedures.

- Red Flag: A KES 10 million cover that only allocates KES 200,000 for cancer treatment. This is a fundamentally flawed policy for anyone with cancer in their risk profile.

- Co-payment & Deductibles: Understand precisely what you will pay out-of-pocket.

- Co-payment: A percentage of the bill you pay (e.g., you pay 10%, insurer pays 90%).

- Deductible: A fixed amount you must pay first before the insurer starts covering costs.

- Red Flag: Policies that apply co-payments to major inpatient bills, which can still lead to a massive out-of-pocket expense.

Illustrative Case Study: Sarah's Policy Autopsy

Sarah, a 45-year-old executive, is considering a plan with an impressive KES 20 million inpatient limit. It seems perfect. But during her Policy Autopsy, she uncovers three fatal flaws based on her Risk Audit:

- Exclusion: The policy explicitly excludes a pre-existing back condition she manages.

- Waiting Period: There is a 24-month waiting period for any cancer-related treatment.

- Sub-limit: The impressive KES 20M limit has a sub-limit of only KES 1.5M for heart-related surgeries—a key concern in her family history.

The policy autopsy saved her from buying a multi-million shilling plan that was fundamentally useless for her specific needs.

Step 5: The Final Litmus Test — Three Non-Negotiable Questions Before You Sign

You've done the work. You've audited your risk, set your budget, scored the providers, and dissected the policy. You have a final contender. Before you sign on the dotted line, run it through this final, clarifying litmus test. The goal is to get a definitive "Yes" to all three questions.

Question 1: The Efficacy Test

"If the worst-case scenario I identified in my Personal Risk Audit (Step 1) happened tomorrow (after all waiting periods are served), does this specific policy, with its specific limits and exclusions, actually solve that problem?"

This question forces a direct, pragmatic link between your biggest fear and the solution you’re about to buy. It cuts through all the noise and focuses on the core purpose of the insurance. If your biggest fear is a KES 5M cancer treatment and your policy only covers KES 500,000, the answer is "No."

Question 2: The Sustainability Test

"Looking at my budget from Step 2, can I commit to paying this premium for the next five years without severe financial strain, even if my income fluctuates or an unexpected expense comes up?"

This question tests your long-term commitment. Health insurance is a marathon, not a sprint. A "maybe" or "I think so" is a warning sign. You need a confident "Yes" to avoid policy lapse and wasted money.

Question 3: The Partnership Test

"Based on my Provider Scorecard (Step 3), do I genuinely trust this company to act as my partner in a crisis, or do I view them as just a vendor in a transaction?"

This final question is about trust and instinct. In a moment of extreme stress, you need an ally, not an adversary. Is this a company you believe will have your back?

Illustrative Case Study: The Njoroges Sign with Confidence

The Njoroges run their chosen KES 280,000 plan through the litmus test:

- Efficacy? Yes. It fully covers maternity at their preferred hospital and provides a solid KES 5M inpatient limit, addressing their primary risks.

- Sustainability? Yes. The premium fits comfortably within their budget, with a buffer for uncertainty.

- Partnership? Yes. Their chosen provider scored highly on claims payment and customer service, giving them confidence.

They sign the documents. The jungle has been tamed. The paralysis is gone, replaced by a profound sense of security. They didn't just buy a policy; they executed a strategy.

From Chaos to Control: Your Turn

Choosing health insurance in Kenya doesn't have to be a journey into confusion. By replacing anxiety with a system, you transform yourself from a passive consumer into an empowered, strategic decision-maker.

This framework—Audit, Budget, Scorecard, Autopsy, Litmus Test—is your map and your compass. It provides a repeatable, logical path through the complexity, ensuring the choice you make is not based on guesswork, but on a deep understanding of your needs, your budget, and the market itself.

Your financial security and your family's well-being are far too important to leave to chance. Don't just read this guide—use it. Block out one hour this week. Open a fresh notebook.

Start with Step 1.

Your future self will thank you for it.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.