Decoding the Deal: How to Read a Kenyan Medical Insurance Quote Like a Pro

If you’ve ever requested a medical insurance quote in Kenya, you know the feeling: 10-page PDF, full of jargon, numbers everywhere, and nothing that actually looks simple.

Insurers love complexity. But if you can’t read a quote properly, you risk buying a plan that looks good on paper but fails when you need it.

This guide will help you read — and decode — a medical insurance quote like a pro.

Table of Contents

- 1. Start With the Big Three: Inpatient, Outpatient, and Premium

- 2. Hunt for the Sub-Limits

- 3. Check the Waiting Periods

- 4. Look at the Hospital Network

- 5. Spot the Co-Payments

- 6. Ask About Exclusions

- 7. Compare Apples to Apples

- Quick Checklist for Any Quote

- Final Word: Knowledge = Power

1. Start With the Big Three: Inpatient, Outpatient, and Premium

Every quote will headline with these three numbers:

- Inpatient Limit → The maximum amount the insurer will cover for hospital admissions.

- Outpatient Limit → The cap for doctor visits, labs, scans, and meds.

- Premium → What you’ll pay (monthly or annually).

👉 Pro Tip: Don’t be dazzled by a big inpatient number (like KES 5M). Ask: “Does it actually cover surgery, ICU, or maternity at that level?”

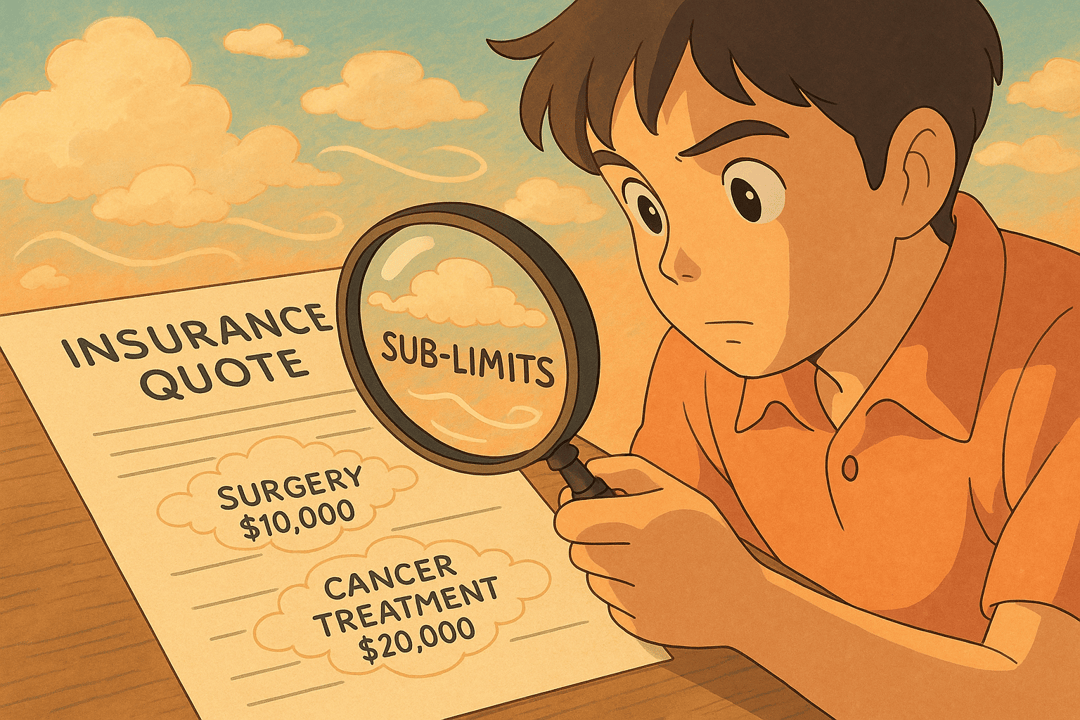

2. Hunt for the Sub-Limits

This is where insurers hide the real restrictions. A “KES 5M inpatient cover” might include:

- Surgery: capped at KES 150K.

- ICU: capped at KES 200K.

- Cancer treatment: capped at KES 250K.

👉 Pro Tip: Read the Table of Benefits line by line. Sub-limits are where most nasty surprises live.

3. Check the Waiting Periods

Quotes often tuck this info in the fine print.

- General illness → 30 days.

- Maternity → 10–12 months.

- Chronic conditions → up to 2 years.

👉 Pro Tip: Buy your cover early. Don’t wait until you need it, because that’s when it won’t pay.

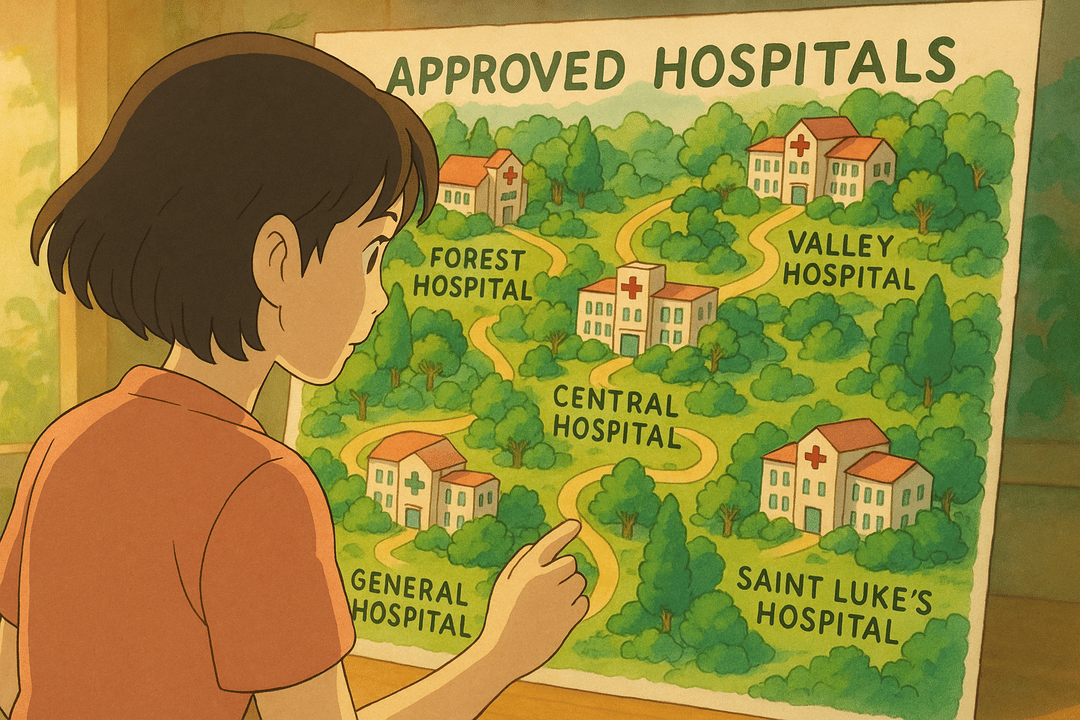

4. Look at the Hospital Network

A quote might show your cover limit, but if the hospital you want isn’t in-network, you’ll still be asked to pay cash.

👉 Pro Tip: Always ask for the list of approved hospitals. Highlight the ones closest to you, and confirm if your preferred hospital is included.

5. Spot the Co-Payments

Some budget plans look cheap because they sneak in co-pays. Example: “KES 500 per outpatient visit.” That means every time you see a doctor, you pay extra.

👉 Pro Tip: Calculate how often you actually visit hospitals. Sometimes a slightly higher premium with no co-pay saves you more in the long run.

6. Ask About Exclusions

Almost every quote has a list of what’s not covered. Common exclusions:

- Cosmetic surgery.

- Fertility treatments.

- Certain pre-existing conditions.

👉 Pro Tip: Don’t assume. Ask directly: “What’s excluded in this plan?”

7. Compare Apples to Apples

Insurers love mixing inpatient-only with inpatient + outpatient, or showing quotes with different hospital networks.

👉 Pro Tip: When comparing, make sure you’re looking at like-for-like plans — same inpatient limit, same benefits — otherwise the comparison is meaningless.

Quick Checklist for Any Quote

- Inpatient limit (and sub-limits).

- Outpatient cover (and co-pays).

- Waiting periods.

- Approved hospital list.

- Exclusions.

- Renewal terms (penalties for lapses).

If a quote ticks your boxes here, it’s worth considering. If not, move on.

Final Word: Knowledge = Power

Medical insurance quotes are designed to overwhelm you. But once you know where to look — the sub-limits, the waiting periods, the exclusions — you can cut through the noise and make a smart choice.

Because the only thing worse than paying too much for insurance is paying too little for a plan that’s useless when you need it.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.