Insurance for Aging Parents in Kenya: A Family Story of Value and Dignity

It often happens on a quiet Sunday afternoon.

The family is gathered, the rhythms of conversation are familiar and warm, and in a moment of stillness, you look at your parents. Really look at them. You notice the new lines etched around their eyes, a testament to a lifetime of smiles and worries. You see the slight hesitation in their step that wasn't there last year, the way your father uses the arm of the chair to push himself up.

And an unspoken thought, quiet but heavy, settles in your mind: They’re getting older.

Table of Contents

- The Problem: The Unspoken Fear That Haunts Loving Families

- Agitate: A Tale of Two Families—The Choice You Are Making Today

- The Solution: Forging Your Family's Healthcare Pact

- How to Have "The Conversation": A Simple Guide

- Your Next Step: From Conversation to Concrete Plan

The Problem: The Unspoken Fear That Haunts Loving Families

Let's be honest. The real fear isn't just about a hospital bill. The financial aspect is terrifying, yes, but it’s a symptom of a much deeper anxiety.

The true problem is the dread of the unknown, the fear of being thrust into a crisis utterly unprepared. It’s the fear of "the call"—the one that comes at an unexpected hour and instantly splits your life into a "before" and an "after."

In that moment, what do you fear most?

- The Fear of Helplessness: The paralyzing terror of seeing a parent you love in pain, while you scramble, panicked, trying to figure out where to go and how to pay for it.

- The Fear of Regret: The chilling thought that you could have, and should have, done more to prepare. The guilt of being forced to choose a second-rate option because the best care is financially out of reach.

- The Fear of Watching Them Fade: Not from their illness, but from the loss of their independence. The fear of seeing your proud, self-reliant mother or father feel like a burden to the family they spent their lives building.

This is the core of it. We are not afraid of our parents getting old. We are afraid of them being stripped of their dignity in the process. We are afraid of a medical emergency becoming a financial and emotional catastrophe that erodes the respect and autonomy they have earned over a lifetime.

Ignoring this fear doesn’t make it go away. It only allows it to grow in the shadows, waiting for a crisis to give it power.

Agitate: A Tale of Two Families—The Choice You Are Making Today

To understand the stakes, let’s leave the abstract and step into the lives of two fictional Kenyan families. Their stories are different, but their love for their parents is the same. The only thing that separates them is a single conversation and the plan that followed.

Story One: The Kamau Family and the High Cost of Waiting

Mr. Kamau was a retired headmaster, a man of immense pride and principle. He and his wife had lived a careful life, raising three successful children. They had their savings, their pension, and the standard NHIF cover. "We'll be fine," Mr. Kamau would say with a confident wave of his hand whenever his eldest son, David, gently brought up the idea of a private medical plan. "We don't want to be a burden with extra monthly costs."

David, not wanting to push his proud father, let it go.

Then came the call. On a Tuesday morning, Mr. Kamau suffered a massive stroke.

The chaos was immediate. The closest top-tier private hospital required a deposit of KSh 500,000 before he could even be admitted to the ICU. His NHIF card was helpful, but it was a drop in an ocean of cost. The family’s carefully accumulated savings were gone in less than 48 hours.

What followed was a slow-motion nightmare.

David and his siblings began a frantic campaign of fundraising. WhatsApp groups were created, messages sent out to extended family, friends, and old colleagues. The family meetings were no longer about their father's recovery prognosis, but about financial strategy sessions filled with hushed, anxious voices. Who could take a loan? Could they sell the small plot of land upcountry?

The worst part wasn’t the money. It was the look on Mr. Kamau's face. Lying in his hospital bed, this titan of a man, who had commanded the respect of thousands of students, now looked on as his children were forced to humble themselves, asking for help. He could hear the strained phone calls. He saw the stress on their faces. Every harambee contribution, while a blessing, felt like a small chip away at his life's legacy of self-sufficiency.

He was no longer just a patient; he was a financial crisis. His illness had become a family burden, and the shame of that was a heavier weight than the stroke itself. His dignity was the primary casualty.

Story Two: The Onyango Family and the Fortress of Dignity

Mama Onyango was a force of nature, a matriarch who ran her home with love and firm resolve. Two years earlier, her daughter, Grace, sat with her on the veranda.

"Mum," Grace had said, her voice soft but clear. "Because we love you, and we never want to worry about your care, I want us to create a family healthcare pact. I want to make sure that if anything ever happens, our only job is to be by your side, not running around trying to find money. Your only job is to get better."

It was an emotional conversation. They talked about mortality, about their fears, but also about their wishes. Mama Onyango admitted she was terrified of ever being a burden. Together, they explored options. With the help of an independent advocate, they found a comprehensive senior medical cover. The premium was a shared family expense, a monthly contribution to their collective peace of mind.

One Saturday, Mama Onyango had a serious fall and broke her hip.

Grace got the call, and her heart pounded with fear. But the fear was different. It was the fear for her mother's well-being, not the fear of systemic collapse.

They went straight to one of Nairobi’s best orthopedic hospitals—a facility that was in their network. At the admissions desk, Grace presented her mother’s medical card. There was no desperate discussion of deposits. No frantic calls to family members. The administrative process was smooth, respectful, and efficient.

The family’s entire focus—100% of it—was on Mama Onyango. They brought her books. They sat with her, sharing stories and holding her hand. They consulted with doctors about the best recovery plan. They were able to be sons and daughters, offering emotional support, not frantic crisis managers.

Mama Onyango, though in pain, was not diminished. She was a patient receiving excellent care, paid for by a plan she rightfully owned. Her independence was intact. Her children were there out of love, not panicked obligation. Her dignity was the shield that protected the entire family from the storm.

These two stories represent a crossroads. The path of the Kamaus is paved with good intentions but leads to chaos, regret, and the erosion of what matters most. The path of the Onyangos, forged through a single, difficult conversation, leads to security, focused love, and the preservation of dignity.

This is the choice that is quietly sitting on your family's table.

The Solution: Forging Your Family's Healthcare Pact

What the Onyango family did was powerful. They shifted their perspective. They didn't just "buy insurance." They forged a Family Healthcare Pact.

This pact is an emotional agreement before it is a financial one. It's a promise that says: "Your well-being is our priority. Your dignity is non-negotiable. We will handle the 'what ifs' now, so we can focus on 'what matters' later."

A comprehensive medical cover is simply the tool that brings this pact to life. It’s the practical, powerful mechanism that guarantees your promise can be kept.

Think about what this pact, empowered by the right plan, truly provides:

- The Dignity of Choice: In a crisis, the ability to choose the best hospital, not just the cheapest one, is paramount. It's the difference between a world-class surgeon and a waiting list. This choice is dignity.

- The Dignity of Independence: The plan ensures your parents are not beholden to their children’s financial capacity. They are cared for by a system they are entitled to. This prevents them from ever feeling like a liability, preserving their sense of self-worth. This independence is dignity.

- The Dignity of the Family Unit: It allows you to remain in your role as a loving son or daughter. Your energy is devoted to emotional support, not logistics and fundraising. It protects family relationships from the immense strain that financial stress can create. This focus on love, not money, is dignity.

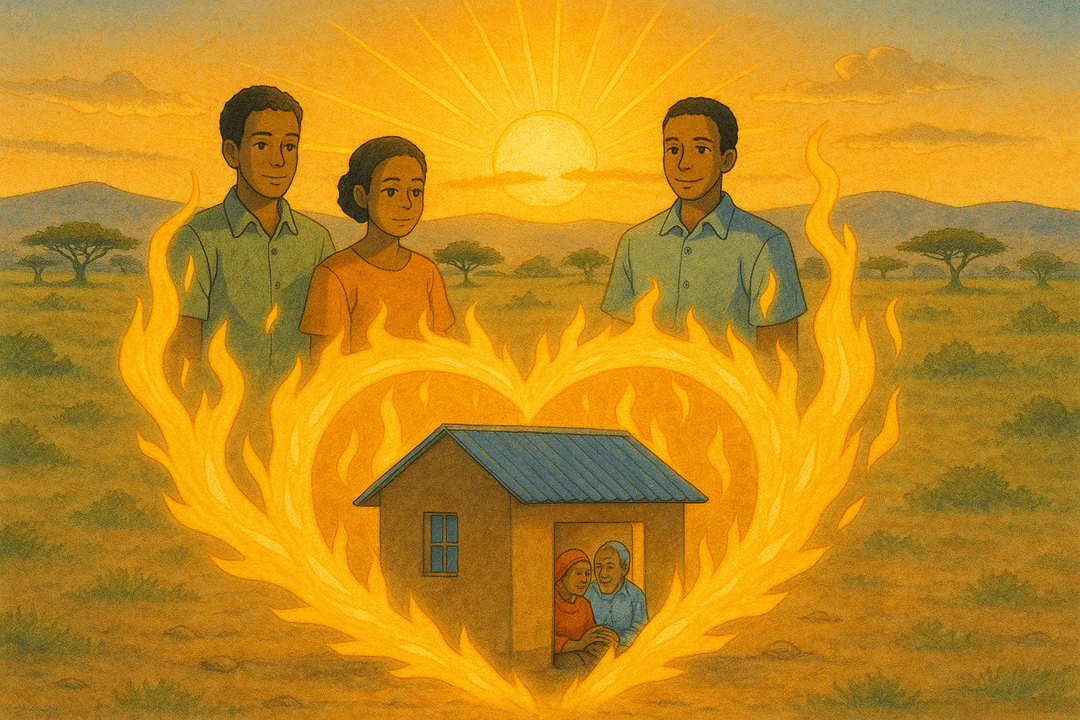

This pact transforms medical insurance from a grudge purchase into the ultimate act of proactive love. It’s the seatbelt for life's most turbulent journeys. It is a fortress you build around your family, not with bricks and mortar, but with foresight and love.

How to Have "The Conversation": A Simple Guide

Knowing this is important is one thing. Actually broaching the subject with your parents can feel daunting. It touches on sensitive topics: aging, mortality, and money. But you can navigate it with grace.

Step 1: Frame it with Love and 'We'.

Don't start with "You are getting older." Start with "we."

- Try this: "Mum, Dad, I was thinking about our family's future. Because I love you both so much, I want us to work together to create a plan that ensures we always have peace of mind, no matter what happens. Can we talk about that?"

Step 2: Focus on Their Wishes, Not Their Frailty.

Make it about honoring them, not managing them.

- Try this: "If you ever needed serious medical care, what would be most important to you? Which hospital would you feel most comfortable in? I want to make sure your wishes are always respected."

Step 3: Be a Partner, Not a Director.

This is a collaboration. You are not imposing a decision; you are building one together.

- Try this: "Let's look at some options together. I can do some research, but this is a decision we should all feel good about. This is for our family's security."

This conversation might be uncomfortable for a moment, but the peace it secures lasts a lifetime. The discomfort of this one conversation is infinitely smaller than the agony of regret.

Your Next Step: From Conversation to Concrete Plan

The most important conversation you'll have is the one about your parents' dignity. The most powerful action you can take is to translate that conversation into a concrete, reliable plan.

Navigating the world of senior medical insurance in Kenya is complex. The policies are filled with jargon—waiting periods, co-payments, sub-limits, and hospital networks. It’s easy to feel overwhelmed, and a mistake can be costly.

You don't have to do it alone.

My role is not to sell you a policy. My role is to be your family's advocate. To sit with you, understand your parents' unique needs and wishes, and help you forge the Family Healthcare Pact that is right for you. I'll help you decode the fine print and compare the options, not just on price, but on the value they provide in protecting what truly matters.

This journey starts with one conversation and is solidified by a plan. You have the guide for the first. Let me help you with the second.

Schedule a complimentary, no-obligation "Family Pact Consultation" today. Together, we will build a fortress of dignity around the people you love most. Let's ensure that when "one day" becomes "today," your family is ready to respond with nothing but focused, unwavering love.

Ready to Get Started?

Get personalized advice and quotes tailored to your needs. No pressure, just honest guidance.

👉 Or start a chat with our assistant now.